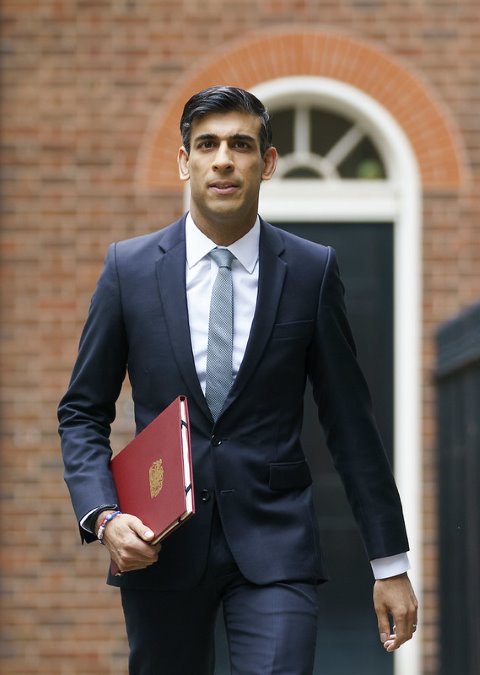

Picture by Pippa Fowles / No 10 Downing Street.

The Covid health emergency is far from over, but UK Chancellor Rishi Sunak has warned that the “economic emergency had only just begun”.

Private client professionals agreed that yesterday’s (26/11/2020) Spending Review was “naturally subdued” and highlighted a set of worrying figures on the state of the UK’s finances.

UK GDP will fall 11.3 percent this...