Thematic investing has gained traction in recent years, and understandably so. The rapid adoption of thematic trends (be it social media, personal computers, or smart phones) often coincide with rapid changes in the economic landscape and success of “new” businesses (Facebook, Microsoft, Apple). From an investment perspective it clearly pays to think about thematic trends - and one of our favourites is Video Gaming and eSports.

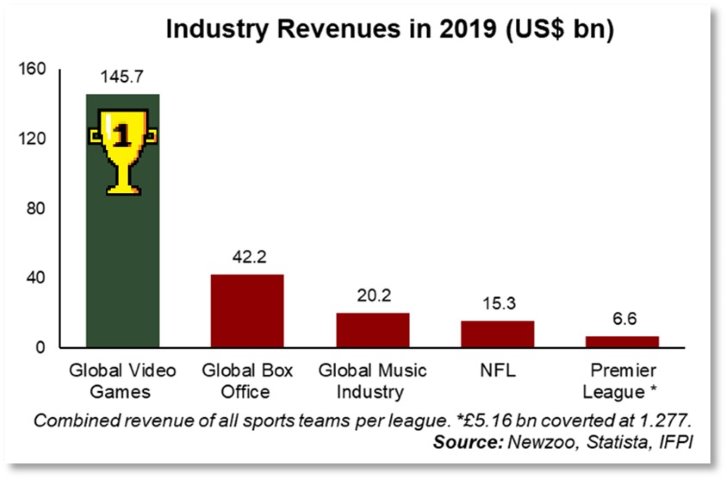

Video games are not just for nerds – they have already gone mainstream. With industry revenues exceeding the sum of Hollywood, the music industry, the NFL and the Premier League combined (see below chart), video games are already one of the largest forms of consumed media.

Even Netflix, in its Q4 2018 shareholder letter, flagged that the company “compete[s] with (and lose to) [video games like] Fortnite more than HBO”. Readers might also be surprised to know that the League of Legends 2017 “Worlds” – with an audience of 200 million viewers - attracted better viewership than Wimbledon and the NFL Super Bowl!

The prize pot for the 2019 “The Internationals” was a hefty US$ 34.3 million – exceeding the prize pot of the NBA 2020 Finals of US$ 22 million. Got your attention yet?

As every investor knows (or at least those that have survived a market cycle), trends that run too hard often get exhausted. In spite of this, we make a compelling investment case for why the video gaming industry has legs to continue its strong growth rate in our research publication “Thematic Trends – eSports & Video Gaming”.

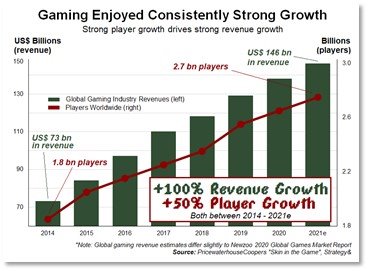

As the chart below shows, revenue is expected to double between 2014 and 2021. Revenue growth is partly underpinned by player growth, which is expected to increase +50 percent to 2.7 billion players over the same period through 2021.

Here’s the kicker; exceptionally fast player growth is expected to remain intact for the foreseeable future with an estimated 3.07 billion players by 2023. Compared to Netflix – a well-known growth stock – the number of video gamers globally is expected to rise 14.1 percent between 2020 and 2023 versus US Netflix viewership growth of “only” 7.2 percent over the same period.

One factor supporting continued player growth is player demographics: One in five players are currently below the age of 18. Furthermore, younger players demonstrate different spending habits. Millennial gamers, the first digital natives, spend an average of US$112 on video games each month – nearly twice the wallet spend of older “Gen Xers”.

Younger players also go hand-in-hand with “eSports” (which is literally competitive/professional video gaming). A Kleiner Perkins report showed that eSports ranked as more popular than conventional US sports like ice hockey and baseball among those between the ages of 21 and 35.

Perhaps, one day, eSports will become the “world’s pastime”. eSports is one of the most exciting facets of the video gaming ecosystem and is one of the fastest growing. It is no surprise that The Walt Disney Company – the owner of the ESPN, ABC, and Disney network – recently signed a multi-year broadcasting deal with Activision Blizzard.

Revenues will also grow as business models shift from Games-as-a-Product to Games-as-a-Service. This shift signifies increased revenue generation from in-game purchases and subscriptions as opposed to a one-time purchase; effectively increasing the longevity of the sales cycle and increasing the scalability of revenue generation versus sunk development costs. The best example of this is Fortnite, a free-to-play game that generated a record-breaking US$ 2.4 billion in revenue in 2018! The free-to-play model also helped Pokémon Go scale to 45 million users in only 16 days!

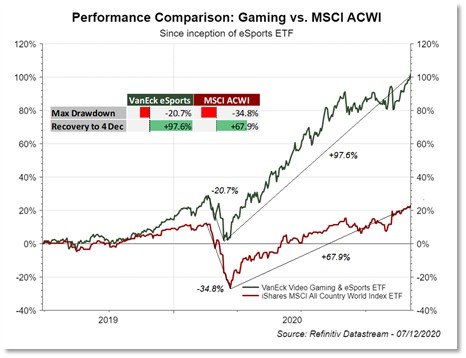

Most importantly, we wrap up our piece with the analysis of one of the many eSports ETFs that we like on the market and one we’ve included in client portfolios. As the chart shows, the VanEck Video Gaming & eSports UCITS ETF demonstrated better performance than the MSCI ACWI UCITS ETF since the ETF’s inception. In our publication we also analyse the longer-term performance of other video gaming benchmarks and other fundamental metrics like valuations, EPS surprises etc. We hope you enjoy this first of several thematic publications which we hope will encourage our readers to think thematic! A free download can also be found here.

Omba Advisory & Investments Ltd advises and manages money for Family Offices and High Net Worth clients. They are also the Investment Manager of the Omba Moderate Risk Global Allocation Fund. They are ETF specialists and build and manage globally diverse, low cost portfolios of ETFs which are robustly managed through a transparent process