The benefits of renewable infrastructure funds to prospective investors mean that Foresight does not lack for competitors across the economic landscape, all of which are looking to combine the downside protection of infrastructure funds with the growth opportunities provided by renewables.

Mark Brennan (pictured), lead fund manager responsible for the FP Foresight UK Infrastructure Income Fund, argues that what sets his fund apart from its rivals is the faith they put in the underlying value of their stocks, trusting their holdings even in times of volatility or potential uncertainty. For them, times of potential difficulty can present genuine opportunities for the fund.

“If we see share prices drop, we still believe in the underlying thesis of the assets. We actually see that as a great time to buy,” he says pragmatically.

For a fund that prioritises income as its investment goal, Mr Brennan does not obsess over the dividend yield of his holdings despite this metric being a clear indicator of the amount of income investors will potentially receive.

The fund has an income target of five percent per annum. However, Mr Brennan explains: “If you simply look at the sector and rank it on dividend yield, you’re going to find some landmines in there. So, there are investment trusts that over-distribute and don’t fully cover their dividend and run very tight coverage. As a metric on its own dividend yield is not one to look at in any kind of isolation.”

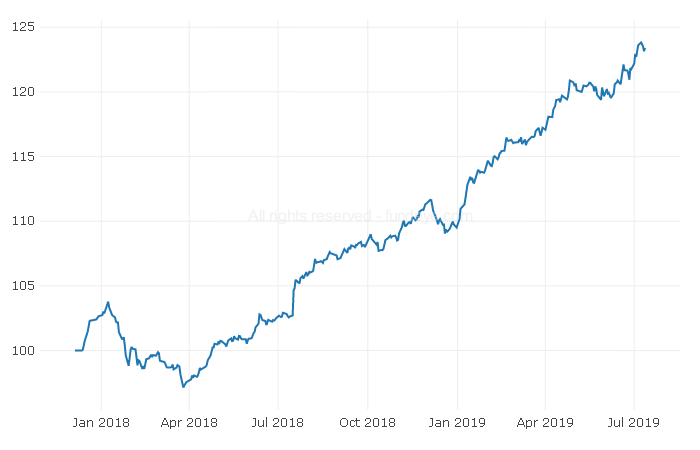

Foresight’s UK Infrastructure Fund was launched in December 2017. Currently it has assets of over £300 million and does not operate specifically against any benchmark. One of the advantages of investing in an open-ended fund that is made up of a selection of well-known listed trusts is investors don’t have to worry about the premium or discount attached to investment companies. If invested in an investment trust that trades on a premium, there is the risk that the premium will shrink at the same time as the underlying investments, doubling potential losses.

Fund of investment companies

This fund is exclusively made up of holding listed investment trusts that results in it having almost half of its assets invested directly into infrastructure and 41.9 percent invested in the renewable energy sector. Its top holdings include well-known names in both these sectors including Sequoia Economic Infrastructure Income Fund, HICL Infrastructure Co, The Renewables Infrastructure Group, International Public Partnerships and John Laing Environmental Asset Group.

As the above-mentioned trusts are all listed on the London Stock Exchange, it would be reasonable to ask why pay an investment manager to package these trusts into an open-ended structure when investors can invest directly into the investment companies themselves?

This is where the skill of the manager comes into play (as well as negating some of the problems trusts present). Mr Brennan argues: “We’ve built a portfolio which we think addresses all the areas of the market that match our investment objective the best. We use different investment companies to access different bits of the market. We can use the portfolio allocation to access what is relevant to our strategy.”

One of the main draws to infrastructure is that it is less correlated to the wider equities market and is far less cyclical than other strategies. When asked about funds that pick individual infrastructure stocks, he dubs these “themed equity income funds” as opposed to pure play infrastructure. His strategy also negates the risks of investing in companies involved in infrastructure projects as the demise of Carillion last year brought to the forefront.

It is not without certain risks though. Mr Brennan says: “You’re often taking a risk on the government or government agency that is underwriting the concession or subsidy payment or whatever it may be.”

Another difference between investing in trusts as opposed to underlying companies involved in infrastructure is that Mr Brennan takes a different view of metrics that might put fund managers off a certain holding. One of these being the amount of leverage used.

“You can approach leverage differently, and you can think differently about the traditional ratios and measures that a traditional equity fund manager might look at. Leverage might look optically high on a set of infrastructure assets but when you look at the underlying nature of the cash flows you can become more comfortable with the length of the project and the counter-party risk.”

Political risk?

Mr Brennan believes a potential Labour government could cause some problems. It’s most recent policy paper ‘Bringing Energy Home’ advocating a renationalisation model would affect share prices of listed funds with high exposure to core UK infrastructure assets.

“We have learned that there is some political sensitivity around some of the names in our portfolio. That sentiment does move some of our infrastructure names around from a share price performance perspective,” he argues.

As mentioned above, if Mr Brennan is convinced of the value of the underlying assets held by his trusts, any share price dip is potentially a time to top up the amount of money invested in the impacted company.

Government policy has also impacted parts of the renewable sector which form a large part of his holdings. The cut in subsidies to solar energy providers drove up the price of assets in place before the change in policy considerably. However, Mr Brennan says the trusts he holds are still investing in assets, even those made after the subsidy cut due, in part, to a novel way of reducing costs.

He believes that some large corporates are striking their own deals with renewable energy players so that the provider is guaranteed a set price for their energy for a number of years, a type of hedge that may prove attractive to both parties. Renewable energy demand is only going to rise in the future, and this fund seems well placed to capture any upside potential.

New additions

Despite the fund seeming to have all bases covered regarding infrastructure, Mr Brennan did add to his portfolio fairly recently. In April, the fund began investing in Greencoat Renewables, which Mr Brennan supported because he fundamentally liked the management team and saw that it had a “chunky equity placing”. This was in reference to the share issuance which raised the company over EUR 147 million, which it intends to use to pay down its credit facility and finance acquisitions.

He says that they have not had issues getting in and out of investment trusts. Or liquidity, to put it plainly.

“We can do quite a lot, depending on timing and placings, without having to go and buy secondary shares off another party. As we become a larger shareholder in some of these names, we get better and better treatment, and we get more and more of what we want when it comes to these placings and it’s an important part of how we get our liquidity,” he says.

Explaining the buying process for the portfolio further Mr Brennan says that the smallest Foresight buy is £400 million in terms of market cap while the biggest it buys “is up into the billions.”

Who is this fund for?

The fund is aimed at a diverse range of clients including direct investors, institutional investors and charities. It is UK-focused with 17 of the 21 holdings within the portfolio being based domestically, alongside two based in the US, and two others in in Canada and New Zealand respectively.

With ESG now becoming core to many institutional investors’ mandates this fund seems a worthy addition. In July 2013, Foresight Group became a signatory to the United Nations Principles for Responsible Investing. Mr Brennan’s background includes a spell of working for the UK Green Investment Bank which further cements this fund’s ethical investing attributes.

It provides diversification with different trusts offering exposure to different segments of both renewable and infrastructure asset classes. For instance, it contains investment companies that are pure play solar energy trusts and others that also consist of wind power as well.

With an ongoing fee of just 65 basis points, this puts the fund on the same price as iShares Global Infrastructure UCITS ETF although the latter is a passive product. With Foresight’s product, you have a knowledgeable fund manager at the helm, who can steer the portfolio depending on which way the wind is blowing (pun intended).

FP Foresight UK Infrastructure Income Fund (GB00BF0VS922))

Targeted annual yield - 5 percent

Ongoing charge 0.65 percent

Fund size - £307.81m

Net Asset Growth Table - (below)

Top Holdings: The Renewables Infrastructure Group, International Public Partnership, Foresight Solar Fund

For more information on this fund please click here