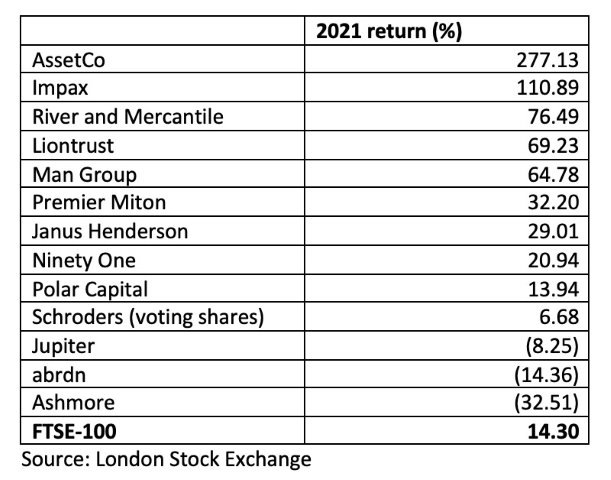

Martin Gilbert’s AIM-listed company AssetCo had an outstanding 2021, returning 277.1 percent in share price terms over the course of the year, outperforming all of its peers across the market cap spectrum (see table).

Compared to the share price performance of a firm he founded that went on to merge with legacy Standard Life, dubbed abrdn - a fund manager who wished to remain anonymous describing the name as ‘basically a terrible scrabble hand’ - the contrast is stark. Investors in abrdn are down 14.4 percent over the same time period.

What drove the outperformance?

“AssetCo provides investors with an opportunity to gain exposure to new areas of investment approach, to secular growth opportunities and to value situations without the same questions of legacy businesses,” writes Rae Maile, a research analyst at broker Panmure Gordon in a buy note on the firm.

The reference to ‘legacy businesses’ is perhaps a tad ironic given the problems caused by 2017’s merger of Mr Gilbert’s emerging markets focused Aberdeen Asset Management with Standard Life but given his assertions of wanting to move his then company into a ‘capital-lite’ entity at the time, may also have been prophetic.

The attributes that Mr Maile assigns to AssetCo include quick decision making, nimble management and shareholder engagement, hardly qualities that could be easily used to describe the behemoths of the sector.

Quick thinking and nimbleness were shown in abundance last year, with AssetCo taking a small stake in AIM-listed asset manager River & Mercantile, larger stakes in Rize ETF and platform Parmenion and then a complete acquisition of Scottish boutique asset manager Saracen Fund Managers.

Writing before AssetCo announced it was intending to make a bid for the rest of River & Mercantile, Mr Maile said the small position taken in the asset manager is “not representative of how we believe AssetCo will develop over time”. How right he was. Later in the same month the note was written, the intention to buy the rest of River & Mercantile was announced.

Given the heightened consolidation within the asset management industry, with firm’s merging to tackle the ever-increasing popularity of low cost passive investing as well as reducing the costs needed to deal with regulatory burdens, it’s clear that Mr Gilbert has found another way. It might be said that the experience of seeing what was once called Standard Life Aberdeen’s share price drop by 25 percent along with shedding around £200 billion in AUM was a formative experience but what a response.

Where to now?

Later this month, AssetCo will decide whether to formally make an offer for the outstanding shares in R&M (with a rival bid coming from Premier Miton) or not.

Mr Maile believes that whatever the outcome, AssetCo would be in a better position as “either it secures the transaction itself, or stands to benefit further as a material shareholder in R&M”.

Some fund managers like to hold asset managers in their portfolios, ironically including one of Mr Gilbert’s acquisitions Saracen Fund Managers. This firm’s UK Alpha fund contained Premier Miton and abrdn at time of writing. With O-IM recently launching an AIM-focused portfolio, the attraction of a fast-growing company like AssetCo may tempt them and others.

However, Mr Maile said that given the early stage of AssetCo’s development it’s difficult to give a valuation of the company.

He added: “Ultimately investing now into AssetCo requires a commitment to future funding of opportunities not yet disclosed, but the track record of management and the early investments suggests the leap of faith is not a great one, we believe.”