Richard Kaye of Comgest recently sat down with Fundtruffle and explained his outlook on the Japanese economy and equity market.

Mr Kaye manages the Comgest Growth Japan fund, which follows a long-term quality growth strategy and has returned 11.99 percent per year since inception (May 2000), out-performing the 7.18 percent over the same period for the TOPIX.

It is a high conviction, growth focused fund, with €3 billion AUM. Over 50 percent of the stocks in the fund have been held for over five years.

Value Stocks and Innovation

While the fund concentrates on growth, Mr Kaye likes to differentiate between growth and quality growth firms, the latter being firms which exhibit far longer and sustained growth.

He highlighted there are very few companies in the world which can keep on growing and keep on replicating what they do. But some, such as Coca Cola, are able to keep growing for 70 years.

Mr Kaye commented: “They've done that because they do something unique. It could just be a drink, it could be something that has a particular consumer loyalty, it could be technology know-how that no-one else can easily imitate.”

As well as the quality of a firm’s business, its uniqueness is a draw for the fund. But many of these firms are poorly researched in Mr Kaye’s opinion.

“The idea of innovating, constantly changing the way you operate - I think it's a very Japanese idea. That's why with a niche style like ours, where we blend quality, uniqueness and sustainable growth, Japan is a very obvious market.”

Japanese large cap sector

The fund typically holds around a 50/50 split between large cap vs medium and small cap firms, but is currently around 60/40 in favour of large cap.

He stressed that large cap firms can “[hide] in plain sight” – meaning firms appearing to do one thing whilst making more earnings from another activity. An example is FANUC, which is known as a robot manufacturer, but makes far more profit from software machine tool interfaces.

“There are lots of other companies in Japan which give the impression of being something but they are actually something else. These companies are often big investment opportunities precisely because they're misunderstood,” Mr Kaye explained.

The same is often true in the mid and small cap space, he added. The actual driver of profits can be misunderstood by investors who do not have a detailed insight into the firms.

Top holdings of the Comgest Japan Growth fund

Top holdings of the Comgest Japan Growth fund

Inflation, and growth to value stock rotation

The fund has had a difficult twelve months, losing 19 percent. This is significantly worse than the TOPIX, which is down two percent.

Mr Kaye remarked: “In the last year and a half you've had this very severe value rotation. The main hero sectors of Japanese economy have been the banking sector and the commodities sector.”

The presumption is that inflation elsewhere will spread to Japan, and that banking and commodities are natural hedges against inflation.

“I think that perception of inflation is wrong. The official CPI data for Japan (March 2022) is 1.2 percent so still very meagre,” Mr Kaye added.

The rally in the Japanese banking sector looks overdone, he added, considering that banks are seeing declining loan volumes and net interest margin flat or down.

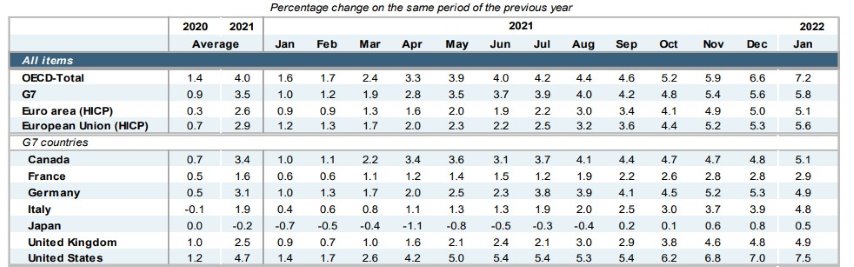

CPI figures for G7 countries, Source: OECD

In his opinion the three factors that will hold inflation in Japan far lower than the rest of the G7 are: lack of wage inflation, house price inflation and a shrinking car market.

Mr Kaye explained: “[Japan] had no major dislocation in the workplace during Covid-19, unlike western economies. Elsewhere countries closed the entire economy for up to a year, and fired millions of workers.”

With other economies coming out of lockdowns and rehiring staff, labour scarcity is increasing, resulting in wage inflation. But as Japan did not shutdown there is not the same pressure to rehire into vacated roles, and so there is not the same upwards pressure on wages.

The falling population in Japan means that housing inflation is another area where Japan bucks the trend seen elsewhere, as there are fewer young people trying to buy houses.

Finally, Japan has a shrinking car market, as more people move to cities where cars are not necessary. Therefore, car prices do not put upwards pressure on inflation figures as they do elsewhere.

Restrictions on the supply of new cars in other countries due to supply chain issues have led to increased prices for both new and used cars, further contributing to rising inflation.

Mr Kaye said: “Each of those factors, wages, houses and cars, distinguish Japan significantly from other markets, other economies. They are the reason we don’t have a dramatic rise in inflation.”

Growth to value rotation is overdone in Japan

Without the increasingly high levels of inflation seen elsewhere in the G7, Japanese rates will not have to rise in the way they are likely to in other countries.

Mr Kaye stressed: “This is the reason why the rotation to banks in the Japanese stock market is mistaken. It is going to unwind, and pretty sharply.”

A lot of growth stocks have been sold and the funds have moved into the bank sector.

“When banks disappoint and when we see earnings for banks are actually not overwhelming, that trade will unwind in short order. And that's where our fund’s performance will come back,” Mr Kaye concluded.