John Wilson, managing director UK and Ireland at Avaloq, discusses how wealth managers can tackle the current ESG challenges and build credibility among investors.

Investing based on Environmental, Social, and Governance (ESG) principles has grown from niche to mainstream. In a survey conducted by Avaloq this year, 42 percent of affluent to ultra-high net worth (UHNW) investors in the UK stated that they already invest sustainably and, according to research by Deloitte, ESG is set to make up half of all professionally managed investments worldwide by 2024.

Regulators, too, are starting to address this growing demand with new rules governing ESG transparency and investor protection. Just last month, for example, the EU put into force its latest amendment to MiFID II, which gives investors’ ESG preferences equal weighting to factors such as risk tolerance and investment knowledge.

The Financial Conduct Authority (FCA) is also taking aim at the sector with the recent establishment of a new advisory committee focused on ESG issues.

But the increased prominence – as well as headlines around greenwashing by major financial institutions – has put ESG labels under greater scrutiny. Despite the popularity of ESG investments, Avaloq’s survey revealed that around two-thirds of UK investors question whether green investments are truly sustainable.

Given the potential for reputational damage and risk of non-compliance, it is vital that wealth managers clearly label their ESG offerings to close the emerging credibility gap. To create a consistent, future-proof ESG offering, wealth managers must have the right data and technology in place.

ESG preferences as a central part of the investment process

Investor preferences for ESG

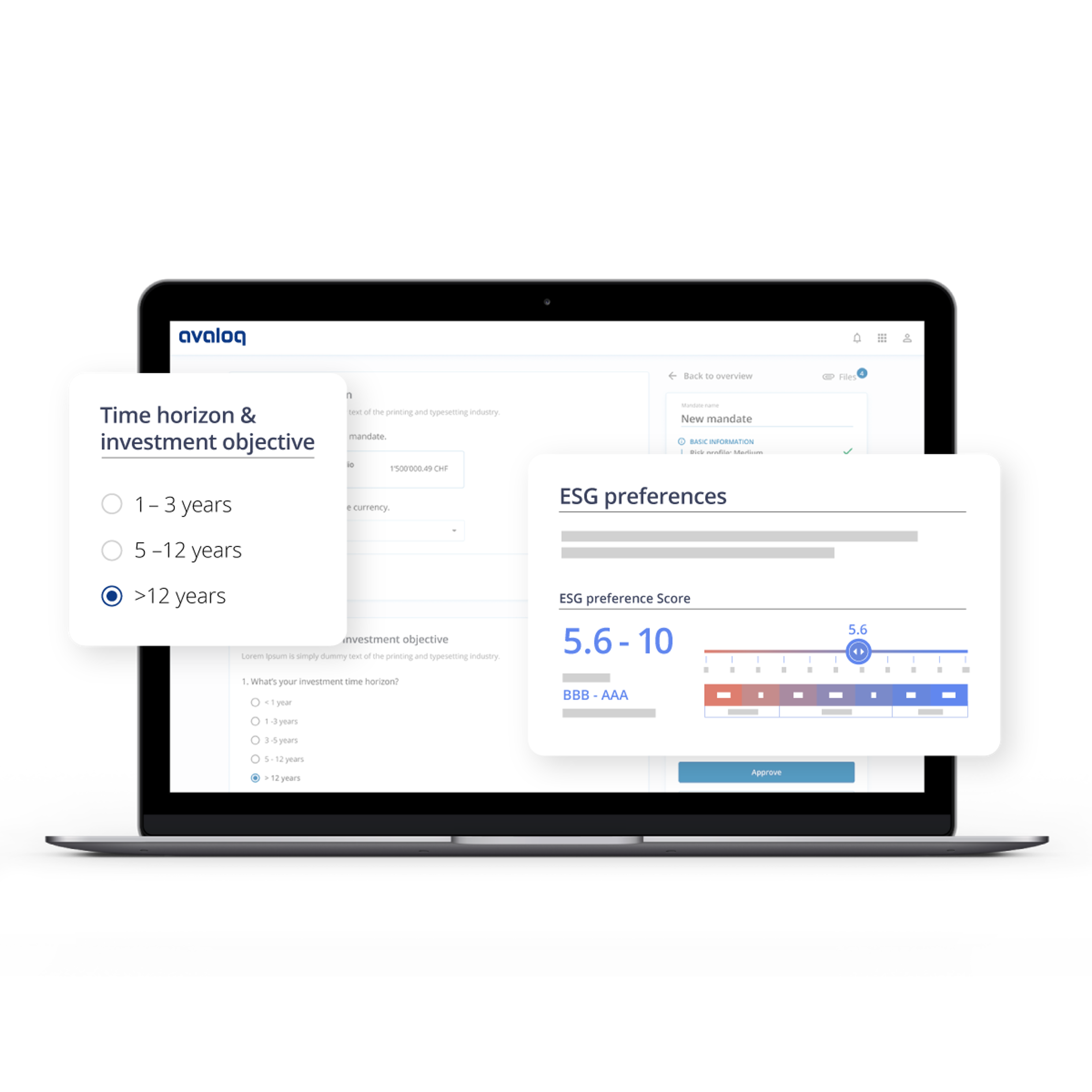

Wealth managers need an advisory system that can seamlessly capture investors’ ESG preferences, integrate them into suitability assessments through an enhanced questionnaire and onboarding process, and deliver regular reports on ESG outcomes.

The ESG solution should record investor preferences based on principal adverse impacts (PAI), define minimum allocations in line with European taxonomy objectives, and classify sustainable investments in accordance with the Sustainable Finance Disclosure Regulation (SFDR).

Investors should also have the option to break down each adverse impact into specific outcomes, for example lower carbon emissions, reduced consumption of resources such as palm oil or improved gender equality.

This approach will not only ensure regulatory compliance, but can help build trust among investors by giving them more control over the composition of their investments. This is supported by Avaloq’s survey, which revealed over half - 53 percent - of UK investors in the affluent to UHNW segment want to be able to more specifically define their ESG preferences.

The right ratings

A particular challenge for wealth managers when it comes to classifying sustainable investments is the sheer variety of ESG rating systems and assessment methods, combined with a lack of standardisation. This means that multiple ratings agencies, on which wealth managers rely for sustainability data, often end up awarding differing ratings to the same company.

Technology can help match investors’ ESG preferences with specific investment products by providing automated access to trusted ESG ratings such as MSCI, which provides clear labels – from Laggard to Leader – and integrating this data into the wealth manager’s investment advisory and portfolio management process.

This can give wealth managers the confidence to recommend ESG investments, enable them to consistently label their ESG investment products and help investors make informed decisions.

The outlook for ESG investing

The competitive strength of wealth managers will increasingly be measured by how transparent, reliable, extensive and accessible their ESG offering is. Investors will simply expect this. If wealth managers wish to remain relevant in the eyes of their sustainability-conscious clients, they need automated support for investor onboarding and suitability assessments, as well as access to reliable data sources to tackle the complexity of the ESG landscape.

As we approach COP27 in November, there will undoubtedly be even more emphasis placed on the role of sustainable investing in reaching net zero, as well as a renewed push to firm up ESG standards. Looking ahead to, say, the next five years, we expect to see greater harmonisation of ESG standards and regulation globally.

We also believe that technology will play an even greater role in ESG investing in the near future. Wealth managers can leverage artificial intelligence (AI), for example, to efficiently process vast quantities of sustainability data, customise ESG investment proposals and create hyperpersonalised newsfeeds.

And by integrating natural language processing (NLP) into the advisory process, investors’ ESG preferences can even be gathered from email, text or WhatsApp conversations with advisers.

For wealth managers today, it is essential to find the right partner to monitor regulatory changes, reflect those updates in their investment technology solutions and roll out prompt software releases to ensure compliance and uniform implementation of ESG standards.

And with compliance taken care of, wealth managers can focus their attention on creating innovative ESG strategies that deliver impact and performance over the long term.

Based in London, Mr Wilson leads the Avaloq UK&I business, growing Avaloq’s local client base as well as driving further expansion in the UK and Ireland wealth management market with new innovative digital platforms.

Prior to joining Avaloq, Mr Wilson spent over 20 years in consulting and industry, delivering successful business transformation, systems integration, and commercial outcomes for leading financial and professional services clients.

John is passionate about creating value for clients through technology enabled business change.