Speak to most wealth managers about Lloyd’s of London and you will be met with a blank stare, or perhaps a story about a friend-of-a-friend who went bankrupt after succumbing to catastrophic asbestos-related losses in the nineties.

The stigma resulting from such horror stories has been hard to shake.

However, today Lloyd’s provides an interesting opportunity, given it allows private investors to make double use of their assets, while potentially producing uncorrelated returns and various tax advantages.

Perhaps most importantly, unlimited liability – which fuelled the aforementioned tales of people forced to sell their homes and businesses – is a thing of the past. Risk management across the entire Lloyd’s marketplace has much improved.

For most of Lloyd’s’ 335-year history, wealthy individuals backed all policies written at the specialist insurance marketplace, though this changed when corporate members were admitted in 1994. Today, the market’s 2,000 or so private members provide about 10 percent of overall capital.

There are three members’ agencies which offer portfolio advice and administration services to private individuals: Alpha Insurance Analysts, Argenta Private Capital Limited, and Hampden Agencies.

As James Sparrow and Ronnie Gray, directors at Alpha explain, one of the main attractions of underwriting at Lloyd’s is the double-use of assets.

Investors can lodge ‘funds at Lloyd’s’ – the collateral used to back the premiums – as either cash, stocks, or bonds which then continue to gather interest, profits and dividends. Funds can also come in the form of a bank guarantee against other property.

“Broadly speaking, if you’re going to put stocks and shares in, you probably want to have relatively low risk. Because we’re going to be taking reasonable risk on your behalf on the insurance side,” Mr Gray says.

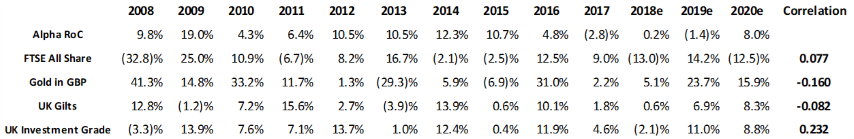

Lloyd’s returns tend to be completely non-correlated to other asset classes.

The members’ agents agree that prospective clients should have at least £7-to-£10 million in investible assets and that any underwriting capacity should represent no more than 10-15 percent of their wealth.

The downsides come via a relatively heavy administrative burden. While Lloyd’s accepts those with minimum collateral of £350,000, writing anything less than about £800,000 – due to the costs involved with running a vehicle – requires a relatively high return to break even.

The investment has a degree of natural structural leverage. To underwrite £1 million of premium income, the cash outlay to buy underwriting capacity will be in the region of £500,000, with a further circa £500,000 of Funds at Lloyd’s to support it. This capital supports three open years of underwriting. The average Alpha client underwrites about £2 million per annum.

Unlimited liability a thing of the past

Since 2003, private client investors – also called members or previously, ‘names’ – have only been able to back policies written at Lloyd’s via a limited vehicle: The most popular being limited liability partnerships (LLPs) or limited companies (called NameCos).

The vehicles have slightly different tax treatments, but both protect assets outside the entity from losses relating to the insurance business, and should qualify for inheritance tax business property relief (BPR).

Mr Gray says there are essentially three layers of risk management, the first being members’ agents, which act as a kind of portfolio manager, advising clients on which syndicates and types of business they may want exposure to – this can be adjusted on an annual basis.

Individual underwriters also have their own risk controls in place.

“Then the Lloyd’s market has, in recent years, introduced effective controls over the individual underwriters. So better underwriters have very loose oversight, and the less good ones are very hamstrung,” he says.

Improving market fundamentals

Intuitively, the tail-end of a pandemic may not seem a great time to get into the insurance game. But Mr Sparrow encourages his clients to see present-day losses as fuel for future returns.

“Unless there are losses at any given time, people begin to think that insurance is less necessary. I always say to [clients] that major disasters are all part of our daily business.”

The insurance market is cyclical, going through soft and hard periods. It is presently in a period of “hardening”, characterised by rising premiums and tighter underwriting standards, with 2017 and 2018 the two worst consecutive years for natural disasters in history. Then came Covid-19.

“When the premium rates are going up, you put your foot on the accelerator,” says Mr Sparrow.

“We’re just moving into the stage of the market which we think could produce some very good returns.”

He concedes there is still a Covid-related “spectre of uncertainty” hovering over the market, though many major expenses – like the cancellation of Wimbledon in 2020 – have already been paid out.

“But of course, there are still potential claims. Everyone is slightly looking over their shoulders saying: ‘We could have some more claims coming and therefore we’ve got to keep pushing the rates up.’

“Happily, we believe that we’ve kept our clients out of those areas of uncertainty.”

Working with wealth managers

David Fell, business development and projects manager at Argenta Private Capital Limited, was previously an investment adviser at Killik & Co, shifting into his present role in 2016.

The majority of client referrals come via word-of-mouth and while the agency works productively with a selection of private banks and wealth managers, in most cases the subject is put in the too-hard basket.

“When I first joined, I always thought Lloyd’s was a ‘best-kept secret’,” Mr Fell says.

“It can be challenging getting in front of people and then the initial reaction tends to be ‘I know someone who knows someone whose uncle lost their shirt 50 years ago’.”

At the larger investment firms, bureaucracy tends to restrict bankers and advisers in terms of the referrals they can make: “They see it as a compliance issue, and don’t want to be seen as advising someone to go into Lloyd’s,” Mr Fell says.

Nevertheless, he says members’ agents can prove a good source of clients for clued-up wealth managers.

“We’re in contact with a lot of very wealthy people and realistically, most clients write at least £1 million. Which means you’ve got a £500,000 to £600,000 pot of cash that may need to be invested. That client may say, do you know a good broker?

“We obviously can't direct them in a specific direction, but we can give them a list and offer an introduction. A lot of investment managers quite like us in that sense.”

And while Lloyd’s can be seen as slightly obscure, Mr Fell argues that portfolios are generally lower-risk than many inheritance-tax-saving VCT and EIS schemes.

“The [Lloyd’s] returns have been incredibly good over the years if you're willing to accept that there is risk to take. I think there's a big educational piece that needs to be done,” he says.