By Eric Khaw, lead portfolio manager – Asian equities, Nikko AM

While concerns about the spread of the Delta variant weighed on markets at the beginning of August, the US Fed’s dovish commentary towards the month-end eased investor worries about any imminent rate hikes.

While concerns about the spread of the Delta variant weighed on markets at the beginning of August, the US Fed’s dovish commentary towards the month-end eased investor worries about any imminent rate hikes.

A rebound in the battered Chinese tech sector further lifted sentiment towards the end of August, before worries relating to the Evergrande crisis took hold in September.

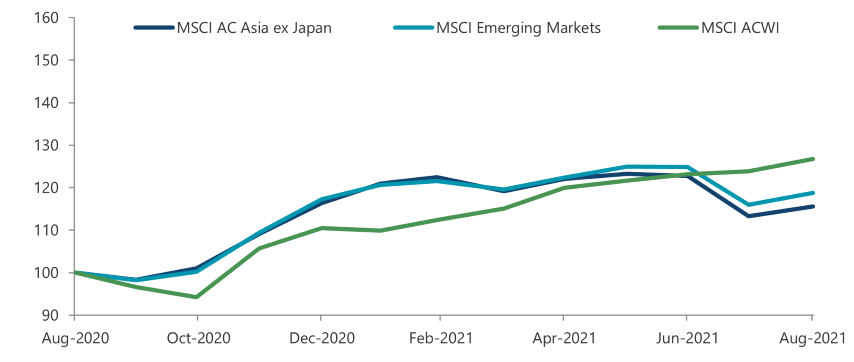

For the month, the MSCI AC Asia ex Japan Index gained 2.3 percent in US dollar (USD) terms with the ASEAN markets generally outperforming their North Asian counterparts. Thailand, the Philippines and India were the best performers (as measured by the MSCI indices in USD terms), while South Korea and Singapore were the biggest laggards.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

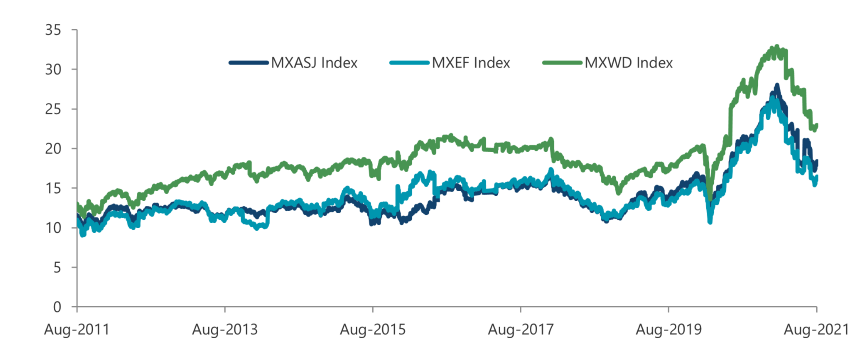

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

India and the ASEAN markets outperform, with the exception of Singapore

In the ASEAN region, Thailand (+11.5 percent in USD terms), the Philippines (+11.3 percent), Malaysia (+8.4 percent) and Indonesia (+7.9 percent) all rebounded from last month’s weakness, with their governments easing movement restrictions on the back of lower Covid-19 caseloads and death rates.

Conversely, despite encouraging Q2 GDP growth of 14.7 percent year-on-year (year-on-year) and the number of the population’s fully vaccinated individuals exceeding the 80 percent milestone, Singapore was the only market to post a negative return of -1.2 percent, as its banking stocks were hit by profit-taking.

India saw a solid gain of 10.9 percent in August, as its economic activity picked up alongside a gradual easing of Covid-19-related restrictions. The country’s GDP growth for the June quarter rose by a record 20.1 percent year-on-year, owing to a weak base last year and improved farm output and industrial activity. Prime Minister Narendra Modi pledged to spend 100 trillion rupees on a national infrastructure plan aimed at increasing productivity and creating jobs.

North Asia broadly underperforms

Elsewhere, North Asia had a muted month. Taiwan (+4.5 percent) was the only market with a positive return in August.

Despite index provider MSCI’s decision to lower Taiwan’s weighting in two of its major indices effective 31 August, gains were led by large cap stocks such as chipmaker Taiwan Semiconductor Manufacturing Co (TSMC) as concerns eased over US Fed rate hikes. China (+0.0 percent) and Hong Kong (-0.7 percent) saw broadly flat returns, as worries about China’s slowing economic growth and an uncertain regulatory environment weighed on sentiment.

Meanwhile, there was some respite after the Chinese central bank made its biggest weekly cash injection into the banking system in the month, while local authorities also urged more financial support for retail and trading firms.

South Korea, which was the worst performer in the region, declined by 1.6 percent in USD terms in August. Its stock market and currency weakened after it became the first Asian economy to raise interest rates since the start of the Covid-19 crisis. The central bank raised its policy rate by 25 basis points (bps) to 0.75 percent from a record low of 0.5 percent, in an attempt to curb rising household debt and inflation.

Market outlook

Leaning on disciplined stock picking approach to navigate uncertain macro conditions

The Delta variant outbreak in Asia and the region’s predominant zero tolerance approach to the pandemic has put a dampener on its economic recovery.

That North Asia has been ahead of its Western peers in credit tightening also suggests that we are likely past the peak of near-term economic growth. All eyes are now on how policymakers would react to slower growth, with Asia well positioned to ease ahead of the rest of the world.

With the macro backdrop far from certain, we continue to lean on our disciplined bottom-up stock picking approach to navigate these uncertain conditions, with a strong preference for companies undergoing structural positive changes and sustainable returns. In particular, the recent sharp market correction has thrown up opportunities in structural areas with policy support such as consumption, innovative healthcare, environment and areas of industrial technology.

Focus on environmental and industrial tech, software and innovative healthcare in China

Apart from the impact of the Delta variant on its economy, China’s economic slowdown has been in part self-inflicted by aggressive domestic credit and regulatory tightening.

Whilst the nature of these regulatory measures has been widely discussed in Western media, we are of the view that the recent regulations are merely an extension of China’s shift from quantity of growth to an era of more sustainable and higher quality growth. Saliently, much of the recent regulations stem from the government’s desire to reduce its chronic income inequality problem, a debilitating issue that the West itself has hitherto no solutions for.

Regulations targeted at reducing the high cost of living ultimately constitute a transfer of wealth to consumers, who are increasingly playing a more pivotal role in the Chinese economy. What is also clear in the current regulatory cycle is China’s deep desire for energy, technology and food independence.

Accordingly, our investment focus continues to be firmly aligned with these objectives of the Central Party, namely in areas such as environmental and industrial tech, software and innovative healthcare.

More selective in South Korea and Taiwan

The never-ending global chip shortage issues, which continue to plague a myriad of industries including automakers, have been a boon for some Taiwanese and Korean tech companies.

The value of chipsets continues to be at an elevated level as supply remains constrained. Unfortunately, increasing Covid-19 caseloads in Korea and Taiwan makes selecting winners complicated. Further, global tech industry competition is also ramping up in the form of sizeable tech supply chain investments in the US.

Hence, with valuations in tech companies still not screaming cheap, we remain selective in hardware tech but continue to find attractive opportunities in content creation, healthcare, and some of the tech sub-sectors.

Rise of internet economy in India and ASEAN should present opportunities

The constant focus on slow vaccination rates in ASEAN and India is perhaps misplaced in our opinion, and risks missing the point that most of the region is much closer to full immunity (through infection rather than vaccinations) than other parts of the world. Indeed, the trend of Covid-19 cases and deaths suggest that the worst is behind us.

What we are focused on is the rise of the region’s internet economy. The industry’s inflection point happened over the last few years with the roll out of the region’s 5G network, rapid smartphone penetration and cheap data plans, which have together democratized internet access to a young tech-savvy population in India and ASEAN.

The digitisation of businesses and small and medium enterprises (SMEs) in recent years have also been a key enabler for the rise of the internet economy. What is also different this time is that the entrepreneurial start up scene has been much more vibrant with free-flowing funding.

Many innovative internet companies are now queuing up to list following the successful IPOs of companies such as Zomato and SEA. For stock pickers like ourselves, these IPOs would make up a rich pool of good quality innovative companies with long term sustainable returns.

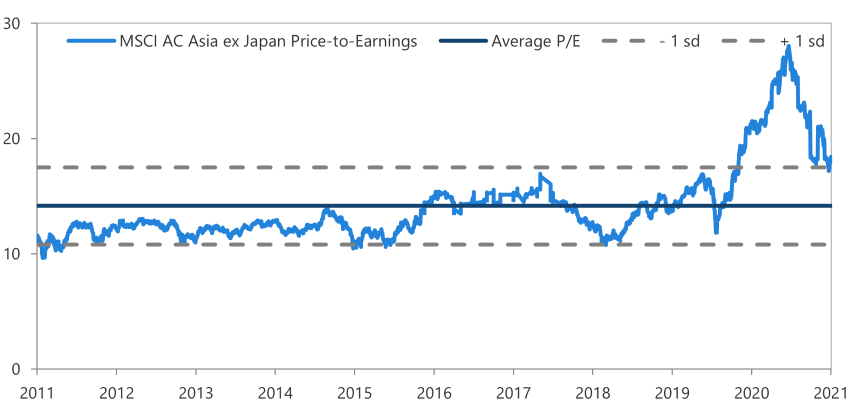

Chart 4: MSCI AC Asia ex Japan price-to-earnings

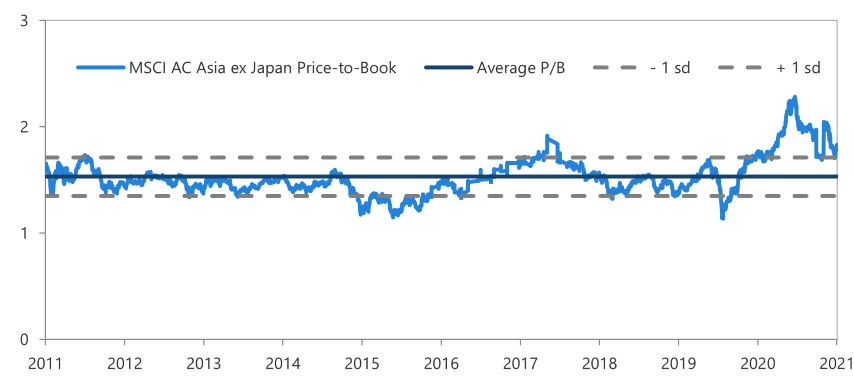

Chart 5: MSCI AC Asia ex Japan price-to-book

Chart 5: MSCI AC Asia ex Japan price-to-book