With the launch of regulated spot bitcoin Exchange-Traded Funds (ETFs) in the US, cryptocurrencies have made another step toward full institutionalisation. With regulated investment vehicles available across the world, it is now virtually impossible for investment professionals to dismiss the asset class as a whole.

Like for any other asset class, it is now necessary for investors and portfolio managers to develop their own views and assign an “underweight” or “overweight” rating to Bitcoin, Ethereum and the rest.

One percent in cryptocurrencies is a neutral allocation

As cryptocurrencies are such a young asset class and because many investors are still relatively unfamiliar with them, it would be easy to think that the neutral positioning is 0 percent investment and that anything above zero is an overweight. But this is not the case.

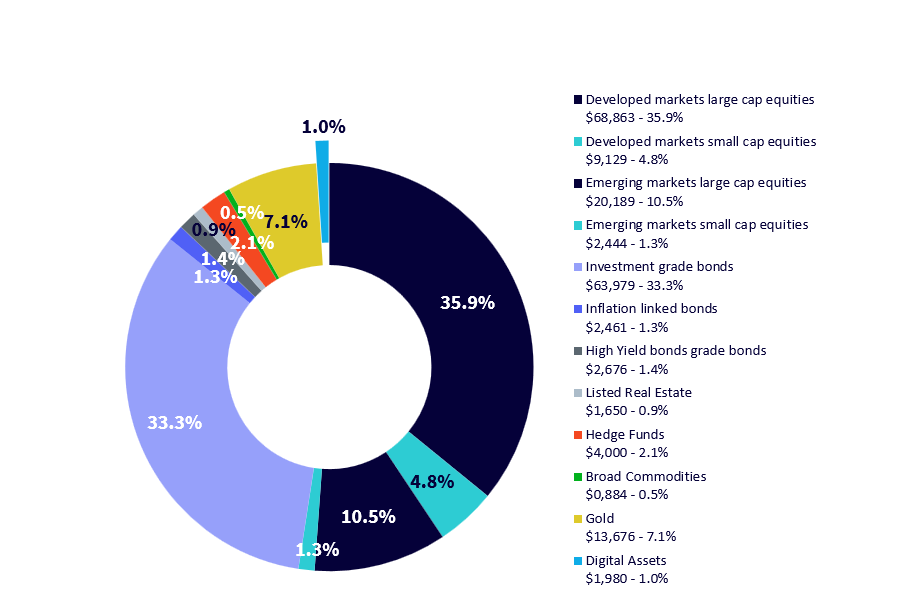

A good assessment of the neutral positioning of an asset in a multi-asset portfolio is to look at the market portfolio, ie the portfolio that simulates the totality of all liquid assets accessible to investors. Figure 1 showcases the current market portfolio.

The total market cap of liquid assets sits at around $191 trillion. With a market Cap of almost $2 trillion, cryptocurrencies represent about one percent of that. This market is now of a similar size to high-yield bonds, Inflation-linked bonds or Emerging markets small caps.

Figure 1: Today’s market portfolio

Source: Bloomberg, WisdomTree. As of 16 February 2024. Market caps are shown in US Dollars billion. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

In other words, nowadays, the neutral position for a multi-asset manager is to invest one percent of its assets in bitcoin and crypto. One percent is the rational choice for investors in the absence of a strong, supported investment thesis that would support a disappearance of the crypto space.

This is a safe position that allows one to benefit from the continued growth of the space in positive scenarios and that allows one to cap losses (at one percent) in more negative scenarios.

Not investing in crypto is taking a negative asymmetric risk against the space

By not investing in digital assets, investors are, by definition, taking an active bet against the asset class. To do so, they would need a strong and clear investment thesis to support that underweight.

A short investment is an asymmetric investment in which the asymmetry works against the investor. They have a capped upside since the asset can only lose 100 percent and an unlimited downside.

So, the risk for a portfolio manager to underweight an asset is a lot larger than to overweight one, as the asymmetry works in favour of the investor in a long position. This is why, investors tend to consider that the conviction and the backing of an underweight need to be stronger than for an overweight.

With highly volatile assets like cryptocurrencies, this is even more important to consider. In the last 12 years, Bitcoin has been the best asset class in nine of them. Furthermore, in six of those nine years, the returns were more than 100 percent*.

So, the asymmetry would have really been positive for an overweight investor and really negative for an underweight one. Those oversized returns are not a thing of the past either. Bitcoin returned 157 percent just last year**.

Conclusion

Looking purely at the characteristics of cryptocurrencies, it is clear that they can bring value to a multi-asset portfolio. With their growth potential, their diversification credentials and ease of investment through regulated investment vehicles, it is becoming increasingly hard for investors to ignore them.

With a one percent investment, investors would be taking a neutral stance on the space, ready to benefit from potential upside and managing the risk by limiting the downside risk to a single percent.

For more information on the impact of adding small amount of crypto currencies in a multi-asset portfolio please see our latest research paper on the subject.

Assets used

| Equities

|

MSCI All Country World net TR

|

NDUEACWF

|

| Small Caps

|

MSCI All Country World Small Cap net TR

|

M1WDSC

|

| All Fixed Income

|

Bloomberg Multiverse TR

|

LF93TRUU

|

| IG Bonds

|

Bloomberg Global Aggregate TR

|

LEGATRUU

|

| Treasuries

|

Bloomberg Global Aggregate Treasuries TR

|

LGTRTRUU

|

| Corporates

|

Bloomberg Global Aggregate Corporates TR

|

LGDRTRUU

|

| High Yield

|

Bloomberg Global High Yield TR

|

LG30TRUU

|

| Commodities

|

Bloomberg Commodity TR

|

BCOMTR

|

| Gold

|

LBMA Gold Price PM USD

|

GOLDLNPM

|

| Infrastructure

|

MSCI World Infrastructure net TR

|

M1WO0INF

|

| REITS

|

FTSE EPRA NARIET Developed TR

|

RUGL

|

* Source: Bloomberg, WisdomTree. 31 December 2013 to 31 December 2023. In USD. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value. See info about asset used at the end.

** Source: WisdomTree, Bloomberg. 31 December 2022 to 31 December 2023. in USD. Historical performance is not an indication of future performance and any investment may go down in value.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.