Simon Rogerson, the chief executive of Octopus

Financial services group Octopus has launched a new service designed to “fill the gap” between robo-advice and traditional financial advice.

Octopus has bought 2017-founded Hatch Financial Coaching and will rebrand it as ‘Octopus Moneycoach’ in a bid to capitalise on the millions it says are looking to adapt to their financial circumstances in the wake of the pandemic.

The service is designed for those who benefit from a human relationship to help make financial decisions, but don’t yet have sufficient assets or complex needs that warrant traditional advice. It will combine financial planning software with financial coaches.

Octopus will also invest £10 million into the business to help scale. This includes plans to increase its number of financial coaches from around 30 to as many as 200 over the next two years, growing the market as it does so.

Adam Price, founder and chief executive of Hatch, will remain as chief executive.

Octopus Moneycoach will work primarily with employers, who offer its services as part of their workplace benefits, with existing clients that include MoneySuperMarket, Sony Interactive Entertainment, Epson, and Experian.

Under such partnerships, advice firms serve employees with more complex planning needs, while Octopus Moneycoach helps those who are typically early-career to mid-life. On average, its customers invest around £10,000 per year.

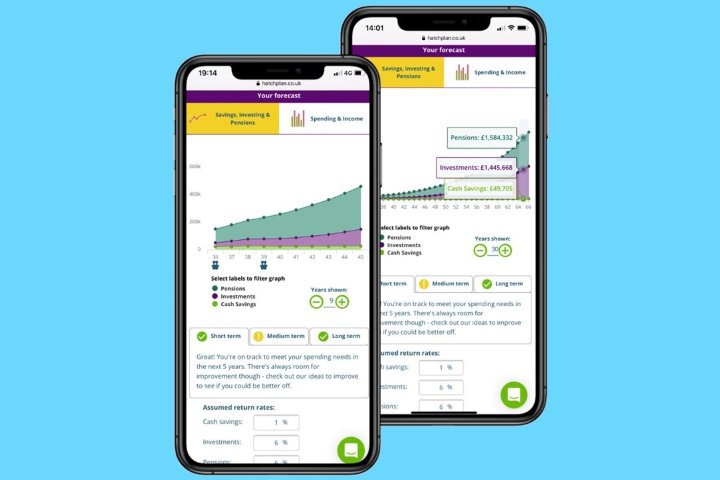

An example of Hatch's planning tools

This reflects an increased awareness of the role employers can play in in supporting the financial wellbeing of staff, with Financial Conduct Authority (FCA) research finding that 9 in 10 businesses think money worries impact their performance.

Simon Rogerson, the co-founder and chief executive of Octopus Group, said there will still “vast swathes” of the population who did not take financial advice.

“This has huge implications for people’s finances but also for their mental health, as money worries are one of the biggest causes of stress.

“Octopus Moneycoach offers a solution to this by providing easy to understand financial coaching at a much lower cost for those people who would otherwise struggle to get help.”

The positive impact of financial coaching can be significant, Octopus says. Within their first year, 55 percent of Hatch clients were able to increase their monthly savings, a quarter increased their pension contributions, while just over half (51 percent) reduced their debt. Almost eight in ten (77 percent) of people achieve at least one of these outcomes.

Octopus has previously highlighted the need for innovation in this space. Last year it published its Bridging the Gap report, which revealed the growing advice gap in the UK and the need for a low-cost solutions for those with more straightforward needs to complement the service offered by financial advice firms.