A fund boutique which has made a series of hires from wealth managers this year says it is looking to shun “modern fashions” in favour of stability and strength.

Duane Hasnip, a former GAM client director focused on intermediary relationships, is the latest to join Tellsons Investors, a fund boutique which runs one fund, the EF Tellsons Endeavour Fund.

Mr Hasnip joins Cranley McFarlane, an ex-JM Finn investment manager, and Damian Cocking, former business development director for Rathbones, who joined Tellsons in April and January respectively.

Mr Cocking said Mr Hasnip would be responsible for forging relationships with DFMs and IFAs, while he himself would focus on the wider marketing and business development strategy.

While performance of the fund has been solid since it launched to market in 2014 (it has returned 16.2 percent over five years compared with its benchmark return of 6.2 percent), assets under management have languished, presently sitting at £42 million. The aim is to get to £100 million, Mr Cocking said.

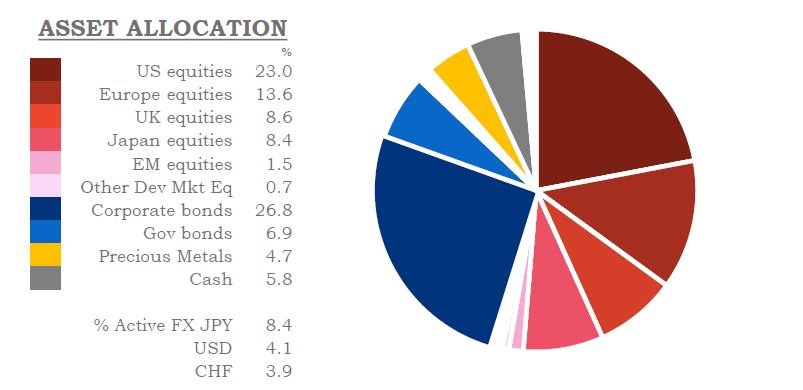

EF Tellsons Endeavour Fund asset allocation as of April 2020

Part of the reason the fund’s business development efforts stalled stems from the death of Michael Lindemann, one of the firm’s four founding partners, who died in 2018 having fallen ill in 2016. Mr Lindemann had acted as head of distribution.

Tellsons is named for the oldest bank in the City of London created by Charles Dickens for his Tale of Two Cities. Mr Cocking said this was meant to represent “stability, strength, and a tendency not to get caught up in modern fashions”.

Joe Bunting

Managing partner and co-founder Joe Bunting said he was pleased with the calibre of staff the firm had been able to attract this year.

“It's an auspicious time,” he said.

“Endeavour is top-rated having proven itself in both up and down markets over seven years since private audited inception in 2012, with just the one fund we manage where the focus and alignment is almost unique in the UK marketplace.

“Alignment and focus may not be the fashionable order of todays' business models, but which are designed to make a clean simple operating platform and provide our investors with reassurance and confidence to stay committed alongside us for the long-term journey that is a lifetime of investment.”